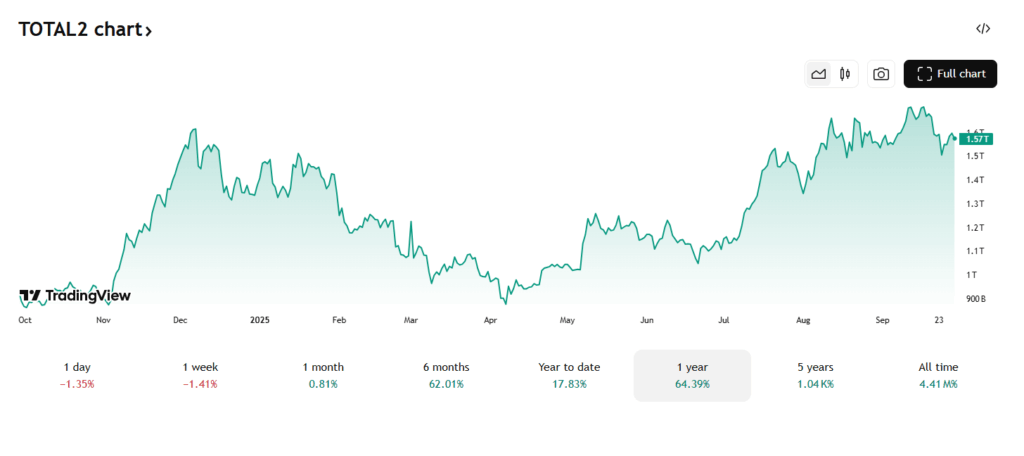

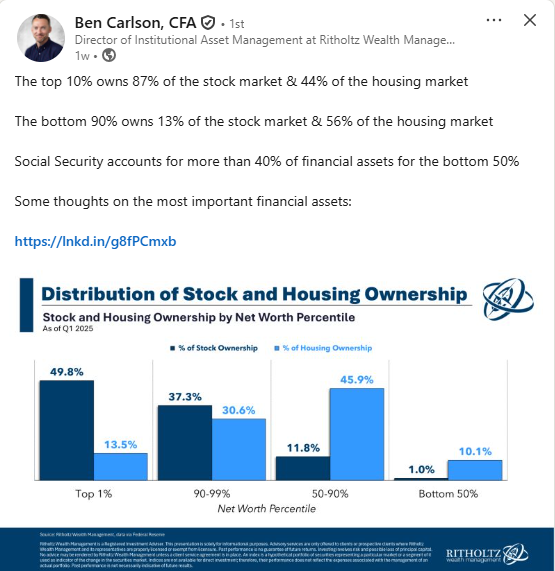

1. Since August Speculative Equity Dominated…Quantum, Crypto and Non-Profit Tech

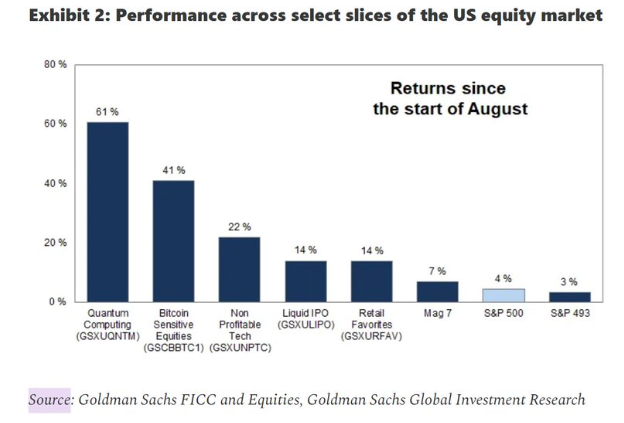

2. Small Cap Non-Profit Stocks Outperforming Quality by 1999 Levels

Zach Goldberg Jefferies

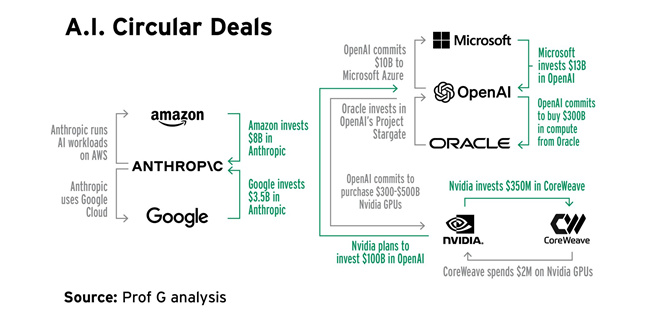

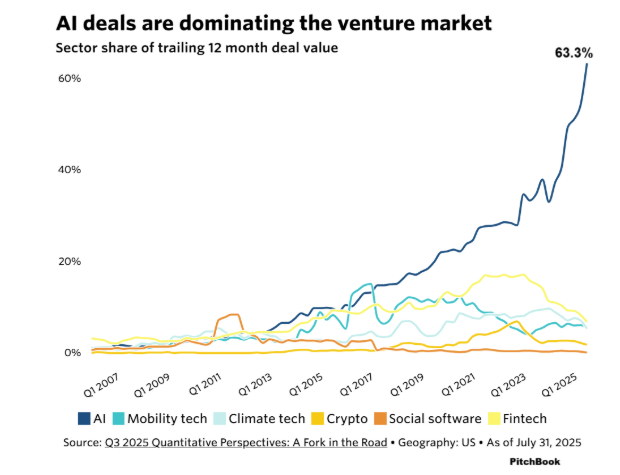

3. AI vs. The World Venture Investing

Wolf Street Blog

Wolf Street

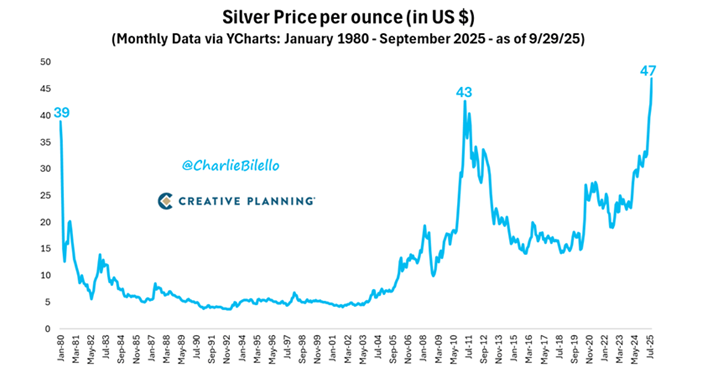

4. Another Look at the Silver Breakout

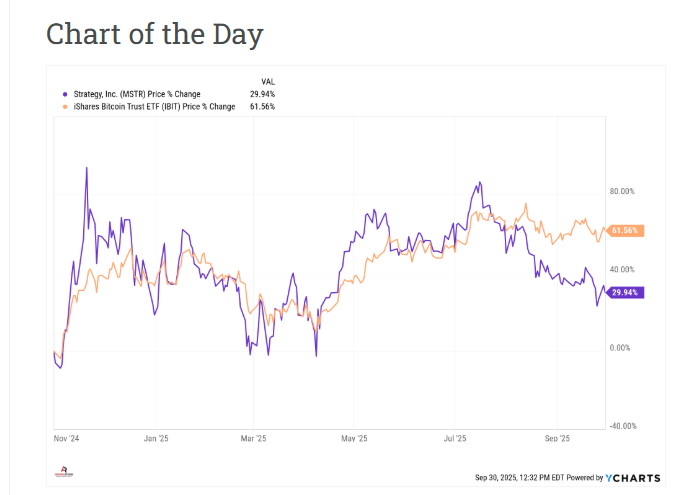

5. MSTR vs. S&P November 2024-Now

Abnormal Returns

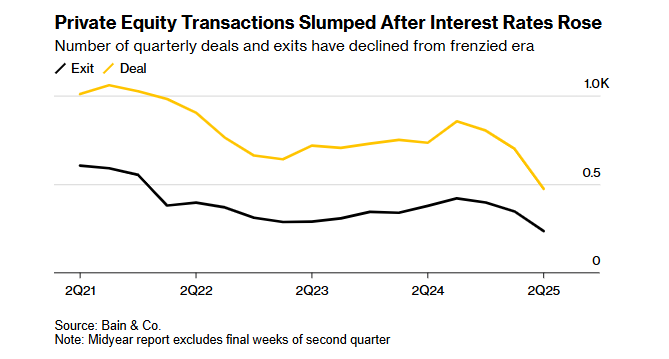

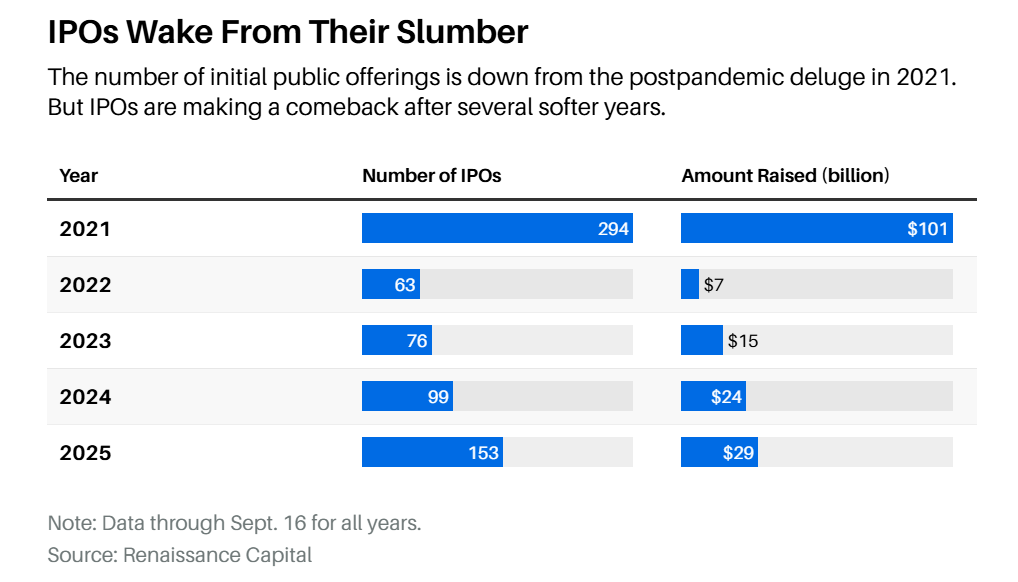

6. IPO Market Still Running at Half the Amount Raised in 2021

Barron’s

7. Dollar Rolling Back Over

Barchart

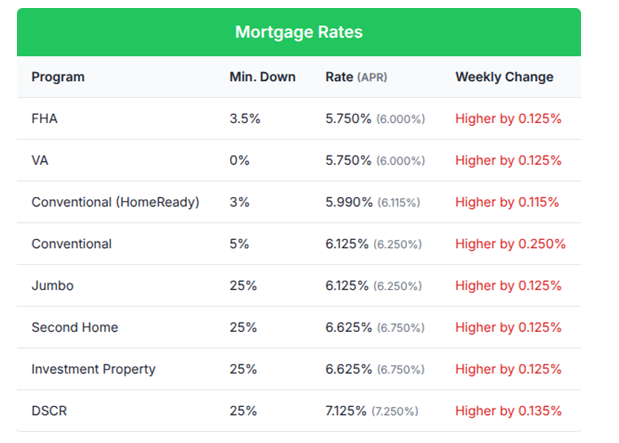

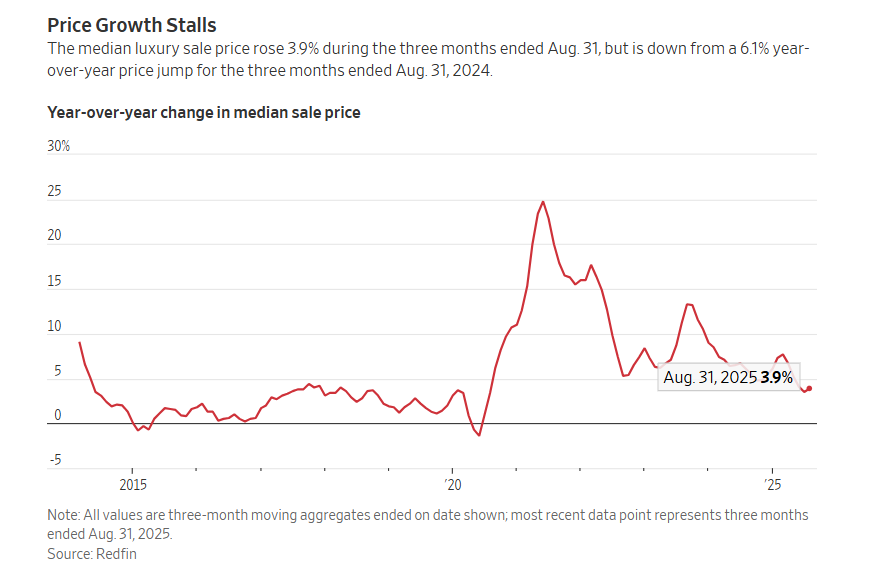

8. Luxury Home Market Slows

WSJ The number of luxury-home sales nationwide dropped 0.7% during the three months ended Aug. 31, compared with the same period last year, according to data from real-estate brokerage Redfin, which said luxury sales nationwide dropped to the lowest level for that period since it began tracking the market in 2013.

Price growth also slowed. During the three months ended Aug. 31, the median sale price for luxury properties—defined as the top 5% of the market—increased 3.9% year over year to $1.25 million, according to Redfin. But that is down from a 6.1% year-over-year price jump for the three months ended Aug. 31, 2024.

WSJ

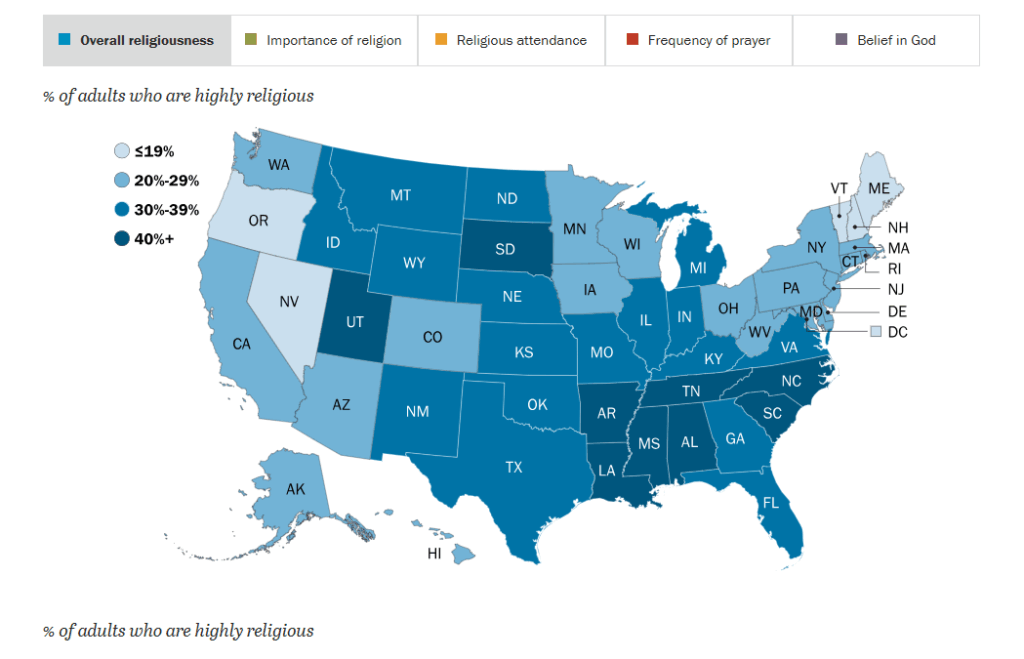

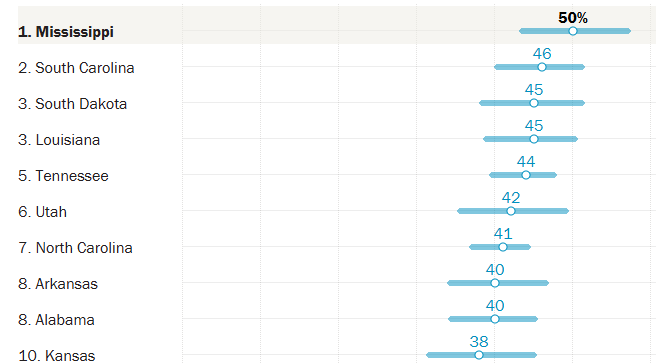

9. How Religious is Your State? Pew Research

Pew Research Center

10. How to Become a Super Learner

Psychology Today Science-based techniques can help you learn more effectively. George S. Everly, Jr. PhD,

Key points

- Science has revealed how to accelerate the learning process, with exercise, multimedia learning, and more.

- Super learning techniques may even help overcome learning challenges.

- Super learning techniques may enhance the brain’s learning capacity through increased neuroplasticity.

In my first year of high school, my father was summoned to my counselor’s office. He was advised to remove me from high school as I would likely not graduate. And if I did graduate, I would certainly never be accepted into college. It seems I was simultaneously burdened with two debilitating syndromes — dyslexia and ADHD. So, while my academic performance was short of outright failure, my prognosis did not seem very positive to my teachers at the time. Against my counselor’s advice, my father insisted I continue in high school.

My father delayed telling me about his encounter with my counselor until my graduation, but it wasn’t my high school graduation. My father decided to reveal his encounter with my counselor only when I reached the age of 27 and had just completed my first doctoral training program. What happened? Now, many years later, having been a professor at two of the leading universities in the world and the author of over 20 books I look back and try to answer the question “What happened?”

Jim McCann (author of the book Lodestar: Tapping into the Ten Timeless Pillars of Success) hosts a popular podcast, “Celebrations Chatter.” He recently interviewed Dr. Barbara Oakley. Oakley’s book, Learning How to Learn, is a national best-seller and her MOOC of the same name has been accessed by over 4 million learners. In her interview, her book, and her MOOC, Oakley describes how she went from an 18-year-old military recruit who hated math to a professor of engineering. What happened? She unravels the mysteries of learning. She describes how to harness an understanding of how the brain works so as to help you become a super learner. Most importantly, however, her message is a message of hope for all of us, especially those of us challenged by formal education or just learning in general.

The Secrets of Super Learning

Interestingly, my own personal journey with learning seems like a confirming case study of many of the techniques advocated by Oakley. Here are several techniques that appear to accelerate learning and creativity that almost anyone can utilize.

- Moderate physical exercise before studying appears to facilitate learning.

- Moderate physical exercise prior to taking a test appears to enhance test performance.

- Try the Pomodoro Technique, wherein you engage in highly focused study, but only for 25 minutes. Then relax for 10-15 minutes. Then repeat.

- Try “pre-sleep learning” (hypnogogic learning). This technique involves studying a problem as you literally fall asleep. The technique is purported to enhance retention and creativity. It was used by Thomas Edison and by Friedrich Kekulé, the chemist who famously envisioned a snake biting its own tail as an analogue for the structure of benzene. And it helped write a textbook that has been in print 45 years (Everly & Lating, 2019).

- Multimedia learning involves taking the material to be learned and converting it into multiple media, such as a) text material, b) listening to an audio presentation of the same text, c) converting the text into a rhythmic poetic cadence, d) combining the text with music, and e) even converting key concepts into representative pictures.

- Use a four-step active learning process: a) study the material for 25 minutes, b) reduce the material to an outline of only the key points, c) close your eyes and relax for 10 minutes, and finally d) have someone quiz you on the material just learned.

- Lastly, harness the Pygmalion Effect. Find a friend or mentor who believes in you and who will support you in difficult times but most importantly be a relentless advocate and source of encouragement.

These techniques may be useful because they harness several mechanisms known to facilitate learning, especially overcoming barriers to the learning process (Oakley et al., 2018; Everly & Lating, 2019).

- They seem to facilitate neuroplasticity, wherein the brain reorganizes itself in order to understand and retain new material. Physical exercise, pre-sleep learning (hypnogogic learning), and repetition are all associated with enhanced learning, likely predicated upon increases in brain-derived neurotropic factor (BDNF). Finding ways of enhancing the release of BDNF may be a key to becoming a super learner.

- Multi-media learning is associated with the recruitment of varied and diverse brain regions serving to complement and enhance the learning process.

- Interpersonal support is the single best predictor of human resilience. The belief and expectations that a teacher, coach, mentor, or parent have for their students can significantly impact who those students become.

While we have yet to discover a practical variant of a “limitless” pill as depicted in the 2011 movie, there is hope. Regardless of what kind of learner you were born, you can be better at it because whatever brain you have, you can make it better – my own journey would seem to support such a conclusion.